capital gains tax canada calculator

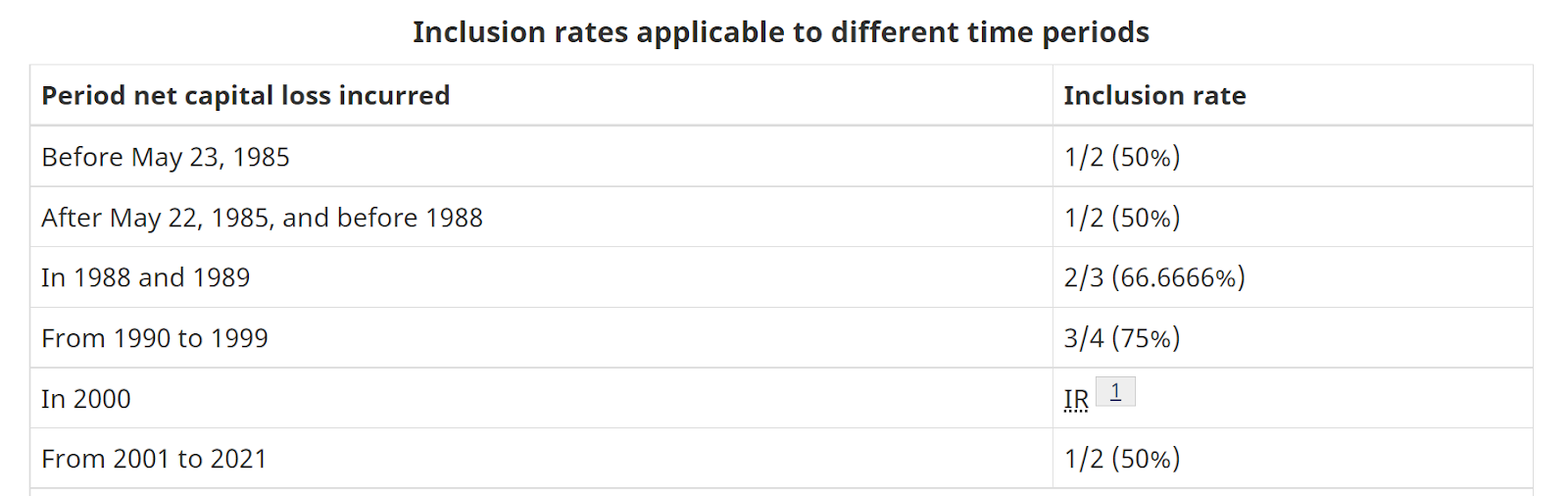

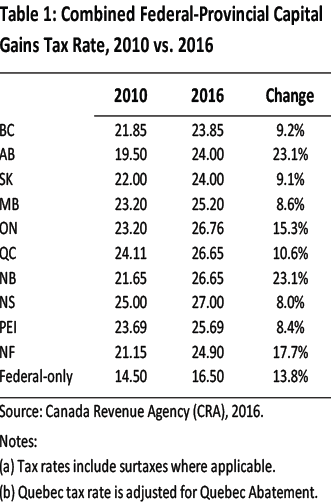

How to calculate capital gains tax is to take 50 of the profit add it to your income and calculate the marginal tax rate for that income this will vary by province. You realize a capital gain if you sell a capital asset and the proceeds of the sale exceed the adjusted cost base.

Completing your tax return.

. Since self-employed income capital gains eligible and non-eligible dividends. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year. Free income tax calculator to estimate quickly your 2021 and 2022 income taxes for all Canadian provinces.

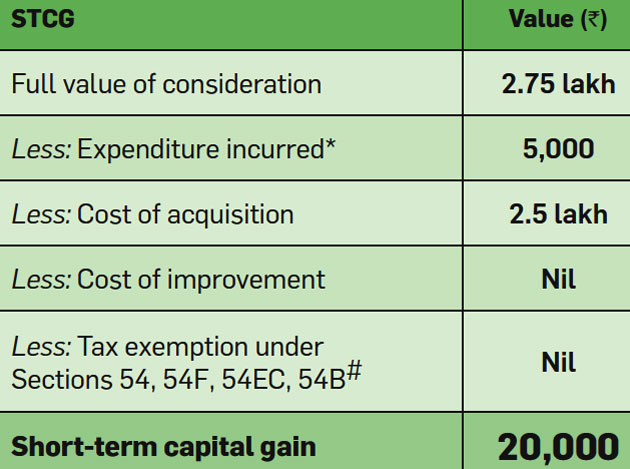

6500 - 4000 60. The sale price minus your ACB is the capital gain that youll need to pay tax on. Calculating your capital gain or loss.

However if you claimed RM13500 in tax. Do not include any capital gains or losses in your business or. Canadian Tax Calculator 2022.

You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and. A Canada Capital Gains Tax Calculator formula that will allow you to manually crunch numbers and get your rate. Learn more with our team of experts today.

At Wefin we provide a multitude of financial tools including our Capital Gains Tax Canada Calculator. 1031 Exchange Hawaii - Capital Gains Tax Rate 2022 1031 Exchange Hawaii Capital Gains Rates State Rate 725 Local Rate 000 Deduction A. ICalculator is packed with financial.

Your sale price 3950- your ACB 13002650. Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs.

Mario calculates his capital gain as follows. However the LCGE allows you to subtract 913630 from your profits in 2022 so you only pay taxes on 950000 913630 x 50 18185 rather than on 475000. If you earned a capital gain of 10000 on an investment 5000 of that is taxable.

All capital gains Calculators on iCalculator are updated with the latest Federal and Provincail Tax Rates and Personal Allowances for the 202223 tax year. Use Schedule 3 Capital gains or losses to calculate and report all your capital gains and losses. Since its more than your ACB you have a capital gain.

In Canada 50 of the value of any capital gains is taxable. Find out your tax brackets and how much Federal and Provincial taxes. Capital assets subject to this tax include real estate land shares bonds.

The things you need to know to calculate your gain or loss like the inclusion rate adjusted cost base ACB and proceeds of disposition. If you have income from sources other than employment use our tax calculator. Adjusted cost base plus outlays and expenses on disposition.

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Capital Gains Tax Canada Managing Capital Gains Taxes

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Crypto Capital Gains And Tax Rates 2022

How Capital Gains Tax Works In Canada Forbes Advisor Canada

3 Ways To Calculate Capital Gains Wikihow

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Capital Gain How To Calculate Short Term And Long Term Capital Gains And Tax On These The Economic Times

How Much Tax Will I Pay If I Flip A House New Silver

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

What Is A Crypto Fork Are Hard Soft Forks Taxed Koinly

Calculate Your Crypto Taxes Using The Formulae Below Or Simply Use My Automated Software Hackernoon

Short Term And Long Term Capital Gains Tax Rates By Income

A Capital Gains And Tax Calculator For Your Stock Crypto Investments R Personalfinancecanada

Personal Income Taxes And The Capital Gains Tax Fraser Institute

What Is Tax Gain Harvesting Charles Schwab